The most frequent question we encounter is – Can NRIs Buy Agriculture Land in India ? Our answer is Yes and No. Read the full blog to get a comprehensive answer.

Despite the restrictions imposed under FEMA (Foreign Exchange Management Act) many Non Resident Indians have a strong desire to own agriculture land in India. Many motivating factors work behind this desire – ranging from the emotional connection to ancestral roots to the pure financial goal to invest in farm land which offers High Return-On-Investment (ROI) in India. Agriculture Income is often viewed as the safest investment. Moreover, agricultural income remains exempted from the income tax in India.

Understanding the FEMA restrictions on NRI land ownership in India:-

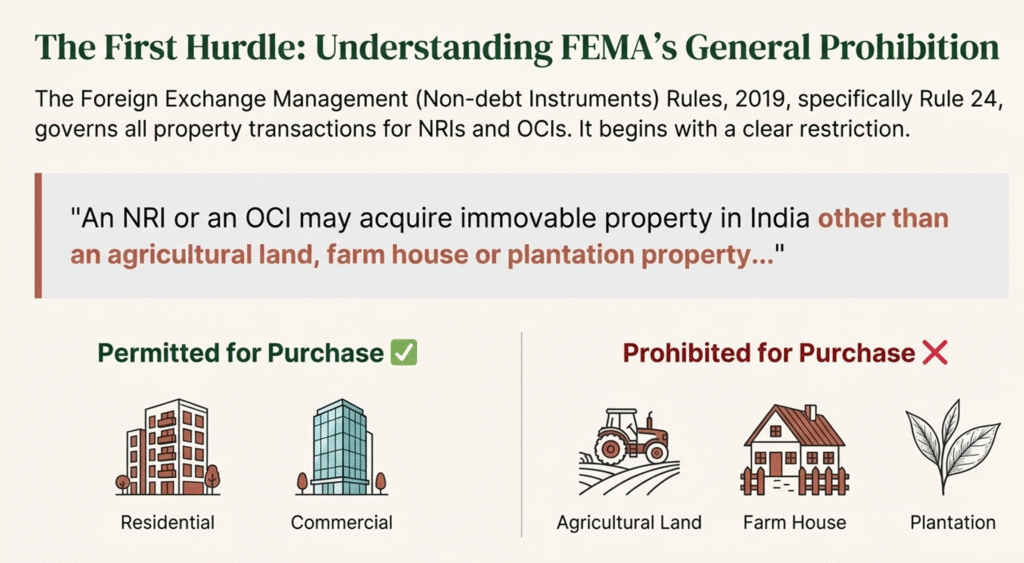

The Foreign Exchange Management (Non-debt Instruments) Rules, 2019 (specifically Rule 24) outlines the acquisition and transfer of property by NRIs and OCI cardholders:

- Purchase: An NRI/OCI may acquire any immovable property in India other than agricultural land, farmhouses, or plantation property.

- Gifts: An NRI/OCI may acquire residential or commercial property as a gift from a resident Indian or a relative (as defined by the Companies Act). However, this excludes agricultural land.

- Inheritance: An NRI/OCI can acquire any immovable property (including agricultural land) through inheritance from a person resident in India or a person resident outside India who acquired the property under the laws in force at that time.

Thus, FEMA regulations strictly prohibit NRIs to buy agriculture land, farm house land or plantation property. It also prohibits NRI receiving such agriculture property as a gift (even from parents or Grand parents). Hence the inheritance based transfer of property is the only way to acquire agriculture land in India.

NRI Land Ownership at a Glance

| Category | Permission | Key Conditions |

| Direct Purchase | NO | Strictly prohibited for agricultural, plantation, or farmhouse land. |

| Inheritance | YES | Permitted from resident Indians or eligible non-residents. |

| Gifting | NO | NRIs cannot receive agricultural land as a gift. |

| Sale | Partial | Agricultural land can only be sold to a resident Indian citizen. |

“ Under the FEMA (Foreign Exchange Management Rules 2019):- Rule 24- Acquisition and transfer of property in India by an NRI or an OCI– “ NRI or an OCI may—

- acquire immovable property in India other than an agricultural land, farm house or plantation property: of: Provided that the consideration, if any, for transfer, shall be made out of

- funds received in India through banking channels by way of inward remittance from any place outside India; or

- (ii) funds held in any non-resident account maintained in accordance with the provisions of the Act, rules or regulations framed under:

Provided further that no payment for any transfer of immovable property shall be made either by traveller’s cheque or by foreign currency notes or by any other mode other than those specifically permitted under this clause;

(b) acquire any immovable property in India other than agricultural land, farm house or plantation property by way of gift from a person resident in India or from an NRI or from an OCI, who in any case is a relative as defined in clause (77) of Section 2 of the Companies Act, 2013;

(c) acquire any immovable property in India by way of inheritance from a person resident outside India who had acquired such property:-

(i) in accordance with the provisions of the foreign exchange law in force at the time of acquisition by him or the provisions of these rules; or

(ii) from a person resident in India;

(d) transfer any immovable property in India to a person resident in India;

(e) transfer any immovable property other than agricultural land or farm house or plantation property to an NRI or an OCI.” Sources of National informatics center: https://thc.nic.in › Central Governmental Rules”

Expert Tip : An NRI can purchase a farmhouse where the nature of land use is changed from ‘agriculture use’ to ‘residential use’ in the official government revenue records. This requires a Change of Land Use (CLU) certificate and the payment of relevant fees to the authorities.

nri lEGAL wORLD

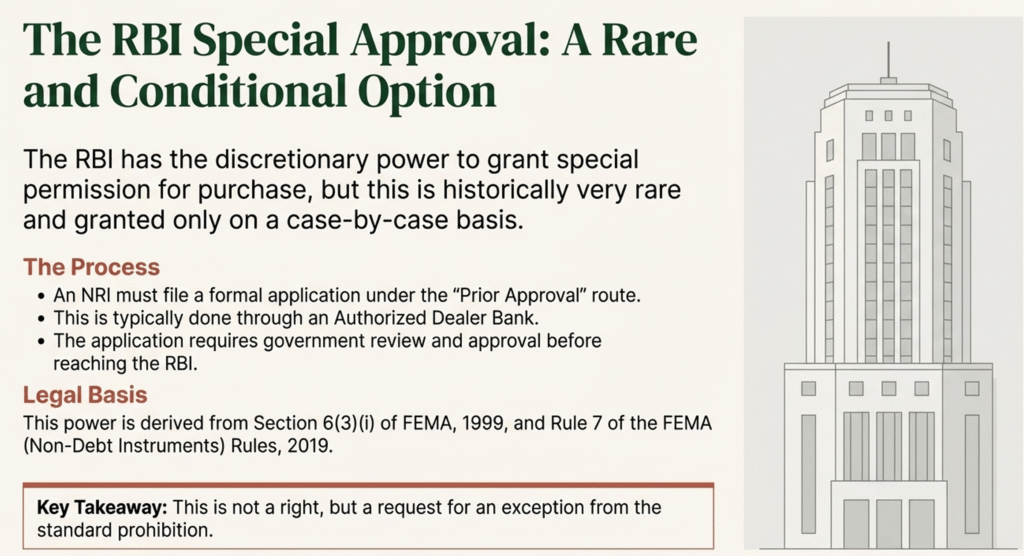

Can NRIs appeal to the Reserve Bank of India (RBI) for permission to purchase the Agriculture Land?

Yes, but it is not a right. RBI can give permission to an NRI to purchase agricultural land in India but only in rare and exceptional cases. An NRI must file a formal application with the RBI (typically through an Authorized Dealer Bank) under a “Prior Approval” route. As per the FEMA rules, an NRI cannot purchase agriculture land, plantation property, or farmhouse in India. Any permission, if at all, comes only through a special approval form the RBI, only in exceptional cases, and after government approval. While FEMA and RBI guidelines generally prohibit NRIs from purchasing agricultural land, the Reserve Bank of India (RBI) does have the legal authority to grant special permission. However, such approvals are granted on the case-by-case basis and are historically very rare. (as per rules under FEMA, purchase is prohibited but RBI has residual discretionary power. Section 6(3)(i) of FEMA, 1999 read with Rule 7 of the FEMA (Non-Debt Instruments) Rules, 2019, Section 6(3)(i) of FEMA, 1999 allows transactions “ subject to such conditions as may be specified by the Reserve Bank”, Rule 7 of FEM (Non-Debt Instruments) Rules, 2019 “except with the prior permission of the Reserve Bank”)

Possible grounds for RBI Permission to purchase Agriculture Land in India

RBI permissions are rare, but NRI can try to give their genuine reason to seek permission in order to purchase the agriculture land in India. The RBI could evaluate the requests based on strict criteria, which may include following Grounds:

- Inheritance linked regularization:

- If NRI is already holding agricultural land through inheritance and is actively involved in active agricultural practices on the Land.

- Large-Scale Agricultural Development: Permission is more likely if the land is intended for high-impact projects, such as large-scale organic farming, agrotech ventures, or food processing units that benefit the Indian economy.

- If NRI’s ancestral property is acquired by the authorities.

- Community Welfare: Projects that aim to generate significant rural employment or provide social infrastructure for a farming community may be viewed favorably.

- Research and Development: Acquisition for setting up agricultural research facilities or experimental farms often carries more weight than individual ownership.

- Pro Tip:– NRIs intentions must be reliable, clear and honest. There must be no scope of speculations.

- Presenting Case for Pre-FEMA or Long-Standing Factual Possession:

- Property acquired before FEMA came into force.

- Or acquired when the person was a resident of India.

- Later became an NRI and seeks regularization.

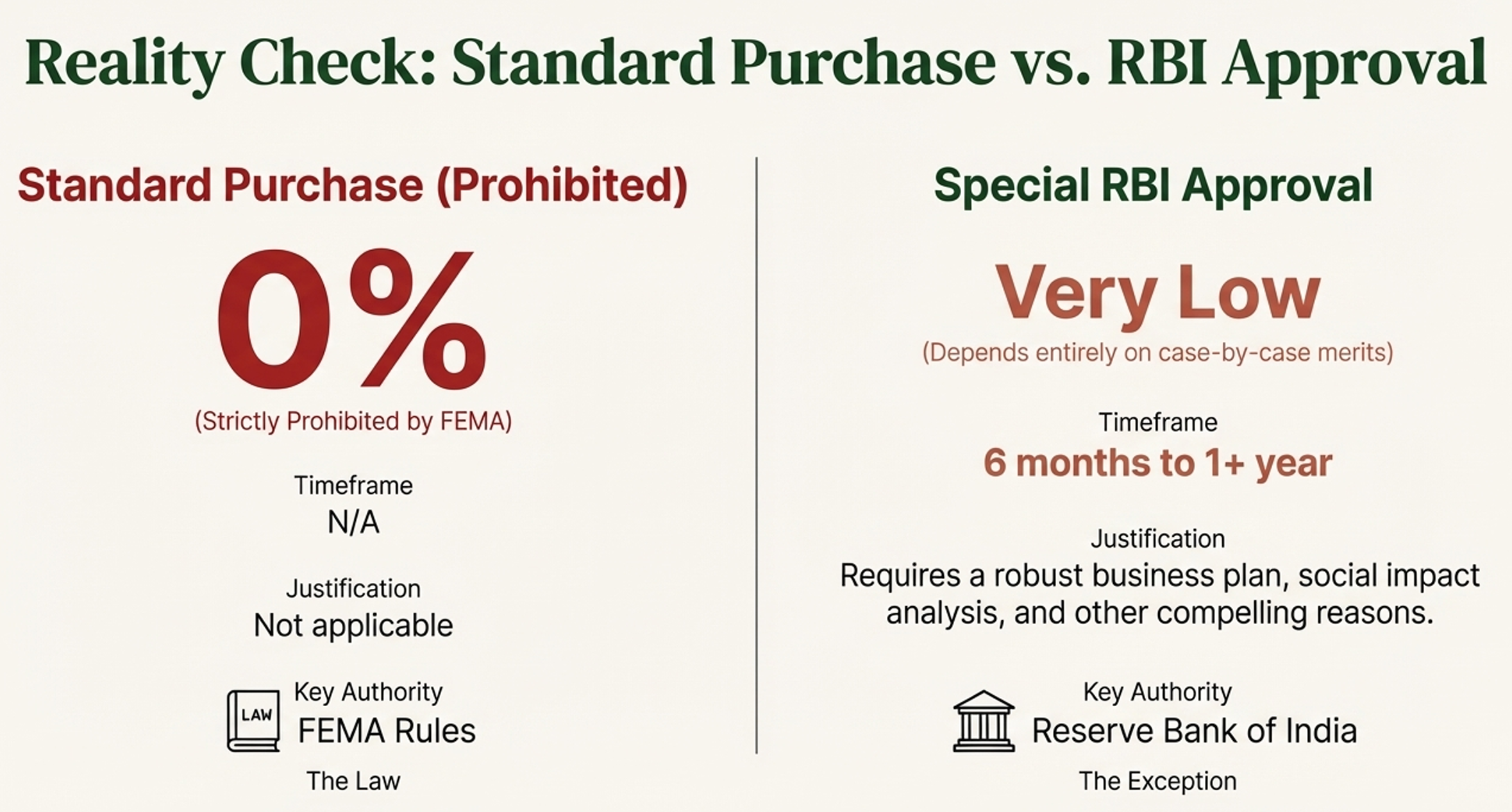

Legal Comparison: Purchase vs. Approval

| Feature | Standard Purchase | Special RBI Approval |

| Probability | 0% (Strictly Prohibited) | Very Low (Depends on Case-by-case details ) |

| Time Frame | Immediate (if legal) | 6 months to 1 year+ |

| Justification | None needed | Business plan, Social impact, any other reasons for purchase |

| Key Authority | FEMA Rules | RBI |

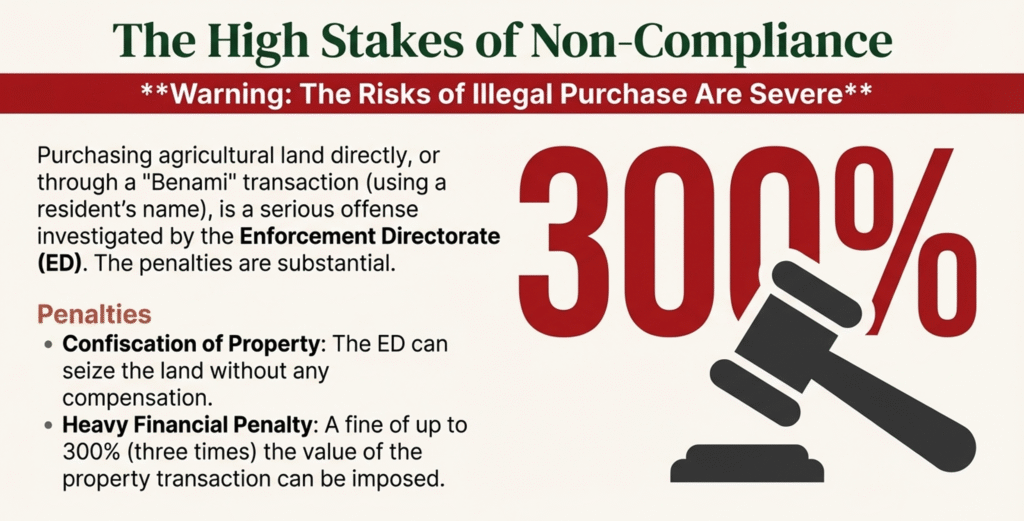

The Risk of Illegal Purchase

In case, any NRI has, knowingly or unknowingly, purchased agricultural land without any kind of special permission of RBI, is a serious offense under FEMA. This can result in a heavy penalty which could be three times the price of the agriculture land purchased and in addition to this the land property can be confiscated. The Enforcement Directorate is the authority to investigate such offenses and can get heavy penalties imposed.

What can the NRIs do in such a situation:

In order to save heavy penalties, the best option will be to approach the RBI and disclose the mistake committed unknowingly and explain the genuine intention behind such purchase. Then if the RBI/ED is convinced of the genuineness, then the transaction to buy agricultural land has some chance to get legalized with some penalties/fines which is decided by the RBI.

To conclude it is strongly advised that the NRI must consult with experts based in India.

Want to know more about this:

Contact us: +91-97096-92096

Frequently Asked Questions

Frequently Asked Questions (FAQs) on NRI Land Ownership of Agricultural Property in India

Q: How can an NRI purchase Agriculture land in India?

A: While direct purchase of Agriculture land by an NRI is strictly prohibited, however the RBI retains the Residual Discretionary Power to grant special permission to buy agriculture land. This option is not a mandatory right for the NRI and is granted only in rare and exceptional cases.

Q: How can an NRI seek permission to buy Agriculture land in India?

A: An NRI must file a formal application (typically after Expert Advice) to seek formal permission to buy agriculture land in India. The final outcome completely depends on the discretion of the RBI.

Q: What are the possible grounds for seeking special RBI permission to acquire agricultural land?

A: While RBI permissions are rare, NRIs can present genuine reasons. These reasons may include requests for:

• Regularization of inherited land where the NRI is actively involved in agricultural practices.

• Large-scale agricultural development projects, such as agrotech ventures, food processing units, or organic farming, that benefit the Indian economy.

• Acquisition for setting up agricultural research facilities or experimental farms.

• Projects aiming to generate significant rural employment or provide social infrastructure.

• Cases involving ancestral property that was acquired by authorities.

• Regularization if the property was acquired before FEMA came into force or when the person was a resident of India.

• The purchase must demonstrate No speculative intent.

Q: What ramifications can an NRI face if he had purchased agricultural land in India, despite the ban under FEMA ?

A: If an NRI, knowingly or unknowingly, has purchased agricultural land without special permission (or uses a “Benami” transaction), it is considered a serious offense. The Enforcement Directorate (ED) can investigate such offenses and can confiscate the property without compensation and/ or impose fines up to 300% (three times) the amount involved in the land transaction.

Q: What are the risks and penalties for an NRI who illegally purchases agricultural land without special RBI permission?

A: Purchasing agricultural land without special RBI permission is a serious offense under FEMA. This can result in a heavy penalty, which could be up to three times the price of the agricultural land purchased, and the property itself can be confiscated. The Enforcement Directorate (ED) is the authority responsible for investigating such offenses.

Q: If an NRI has already purchased agricultural land unknowingly, what steps should they take to mitigate the risk?

A: The recommended course of action is to approach the RBI and disclose the mistake, explaining the genuine intention behind the purchase. If the RBI or ED is convinced of the genuineness of the situation, the transaction may have a chance to get legalized, typically involving the payment of some penalties or fines decided by the RBI.

Q: Can an NRI appeal to the Reserve Bank of India (RBI) for permission to purchase agricultural land?

A: Yes, the RBI does have the legal authority to grant special permission, but this is not a right and such approval is granted only in rare and exceptional cases. An NRI must file a formal application with the RBI (typically through an Authorized Dealer Bank) under a “Prior Approval” route. Historically, such case-by-case approvals are very rare, though the RBI has residual discretionary power under FEMA.

Q: Can Non-Resident Indians (NRIs) or Overseas Citizen of India (OCI) cardholders purchase agricultural land in India?

A: The answer is generally “No,” based on the restrictions outlined under the Foreign Exchange Management (Non-debt Instruments) Rules, 2019. The Foreign Exchange Management Act (FEMA) regulations strictly prohibit NRIs/OCIs from directly buying agricultural land, farmhouse land, or plantation property.

Q: What is the primary method by which an NRI can acquire agricultural land in India?

A: The only legal way for an NRI or OCI to acquire agricultural land is through inheritance. This inheritance can be from a person resident in India or a person resident outside India who acquired the property lawfully at the time.

Q: Can an NRI receive agricultural land as a gift?

A: No, FEMA regulations prohibit an NRI/OCI from receiving agricultural property as a gift, even if the gift is from a parent or grandparent, or any relative. While an NRI/OCI may acquire residential or commercial property as a gift, agricultural land is specifically excluded.

Q: If an NRI wishes to sell agricultural property they already own, to whom can they sell it?

A: Agricultural land owned by an NRI can only be sold to a resident Indian citizen.

Q: Can an NRI purchase a Farmhouse in India?

A: Yes, but only if the nature of the land use is officially changed from ‘agriculture use’ to ‘residential use’ in the government revenue records. This requires obtaining a Change of Land Use (CLU) certificate and paying the relevant fees to the authorities.