Flashy ads, Big promises of Lucrative returns, huge Return-on-Investment promises, Screenshots of profits with unrealistically high percentage, hours long zoom meeting with almost real-looking mentors and even membership to whats app group with people ‘acting’ as high-end business managers, have become the most effectively used tools to lure NRIs to fall in the trap carefully orchestrated by Transnational Cyber Crime Syndicates. The cyber security experts in India name these as New Age Investment Scheme.

India is currently facing a wave of sophisticated cybercrimes in the form of bogus investment and IPO scams that are orchestrated by international syndicates. These scams are executed from countries like Cambodia, Myanmar, and the UAE.

Common Modus Operandi of Online Investment Scams

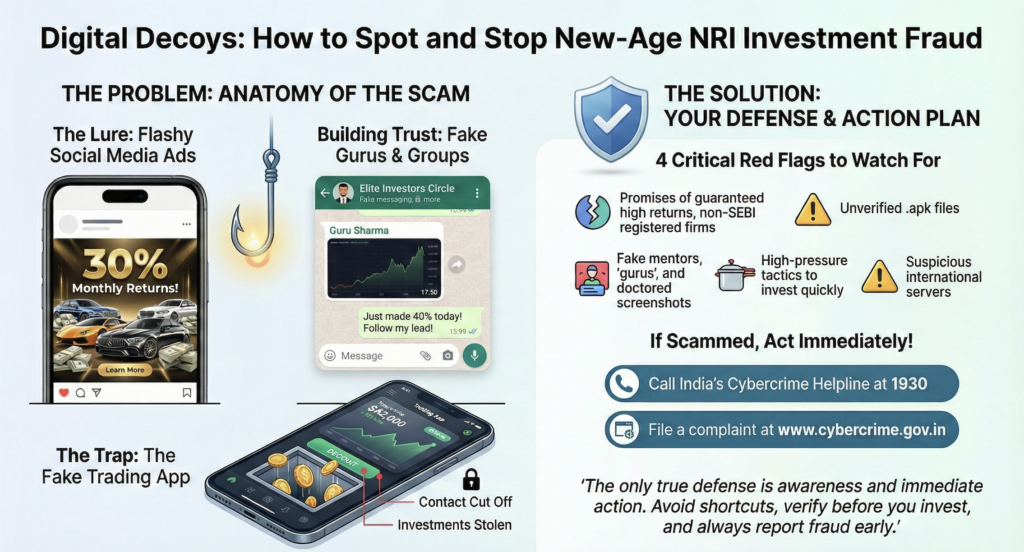

It all starts with a click on a flashy and cathcy ad, on the social media wall while scrolling through platforms such as Facebook and Instagram. For instance, ads promising 30% to any higher figure % of monthly return on the investments from a vast portfolio from stock market to IPO investments. The scammers, to support these unrealistically high profit margin promises, often back their claims with offers of “foreign institutional investor-backed schemes” or “guaranteed IPO allotments.” Once the user is lured to the offer and start engageing with the details provided by the advertisement, its near to impossible for anyone to realise that this appealing facade is a well-planned trap laid out by international syndicates. To win over the trust, the user then added to a WhatsApp group with fake mentors, online meets with other bogus managers, hours long lectures on stock market trading and photoshopped/ doctored screenshots of profit margins to impress the user to download a trading app, often provided with .apk file or thirdy party link file that mimics genuine apps.

Not only manipulated data of stock trading and bogus profit margins are shown on the fake app to impress the user, but also, to win over the confidence, the user is allowed to withdraw the small profits. This is a psychological trick the scammers use to encourage the user to invest bigger amount of money through the app. It is to win the trust. When the user starts investing serious sum of money, from a few thousands to multiple lakhs, the real scam unfolds. Either the app suddenly crashes, login access is denied, or withdrawals are denied, the WhatsApp group gets deleted, admins disappear, and all points of contact are lost.

Quite sophisticated modus operandi. Isn’t it! And this all started with just a click.

These, New-Age Investment Scams can camouflage their traps well or change their tactics anytime to lure more and more victims.

Worst is yet to come!

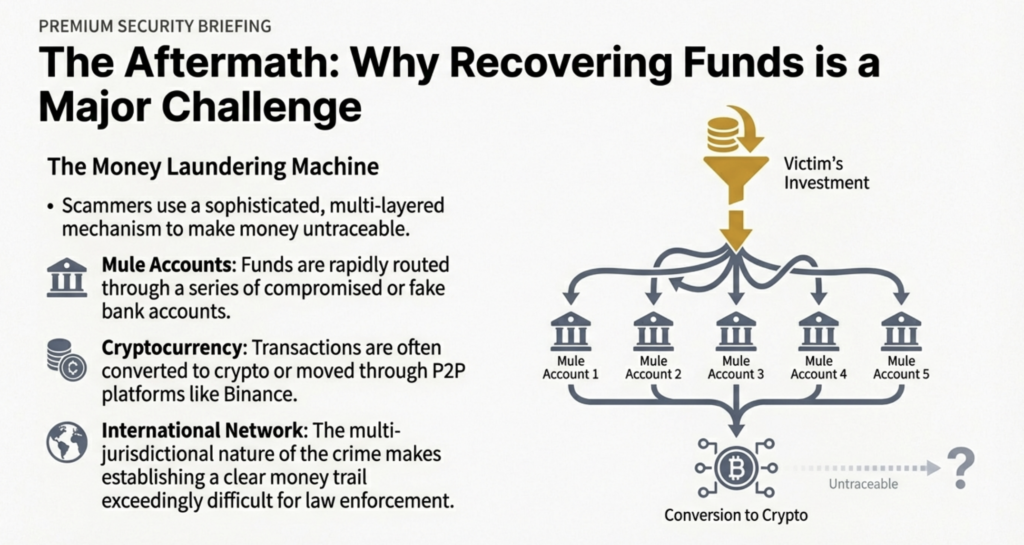

It is Hard to recover the money lost to new age investment scams, as they use multiple mule accounts to route money via series of bank accounts and use multi layer money laundering mechanism to make the money disappear. In many cases, by cybercrime police, its reported that these cyber syndicates often use crypto transactions or P2P payment methods like Binancee. Thus making it hard to establish the money trail and recovering funds becomes difficult.

What to do next if you become a cyber crime victim?

– NRI Legal would encourage the victims to File an FIR and inform the cyber crime police with all the details of the crime. Attach all the digital evidences in the FIR. Law enforcement is also pursuing these cases by tracing financial transactions, IP logs, and requesting international data with support from agencies like I4C and CBI.

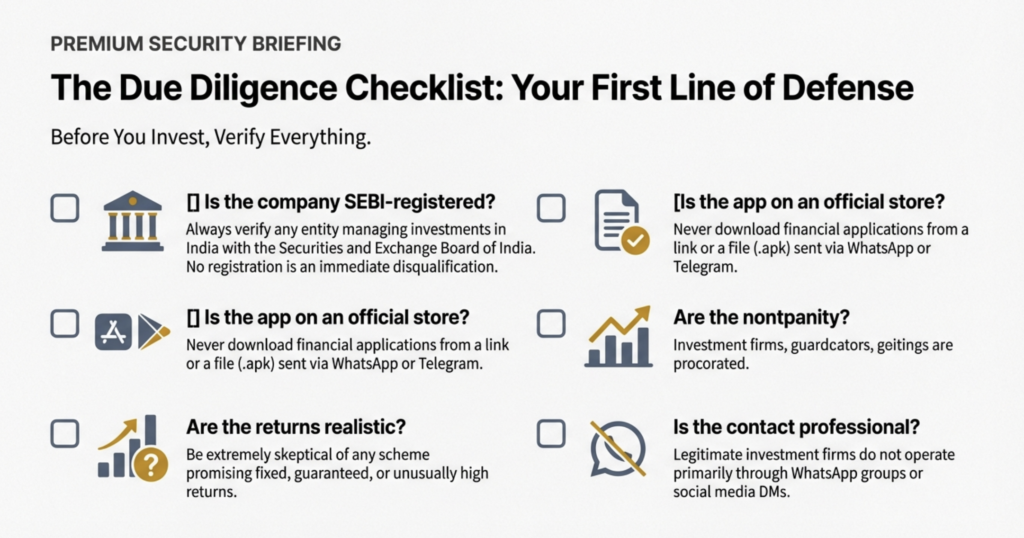

– Never download .apk files sent via Telegram or WhatsApp.

-Always check if the company is SEBI-registered before investing.

-Use open-source tools like urlscan.io to analyze suspicious websites and ipinfo.io to check server origins.

-If the app or website shows or uses international servers with no clear contact information, consider it a red flag.

-In case you or someone you know has already fallen into such a trap, act immediately.

-These scams fall under organized cybercrime, and are now recognized under the Bharatiya Nyaya Sanhita (BNS), effective from July 1, 2024.

-Call the Cybercrime Helpline at 1930, and file a complaint at www.cybercrime.gov.in. Include screenshots, transaction histories, WhatsApp group details, and any communication with the scammers. Time is critical ,faster action increases the chances of freezing mule accounts and recovering funds.

-To protect yourself, it is crucial to remember that no genuine investment scheme promises fixed or unrealistically high returns especially not through WhatsApp groups or social media ads. We recommend you to seek professional advice if you see any investment offer promising hefty returns. You can call NRI Legal World and can talk to our experts about any of your concerns regarding cyber crime.

– These scams are not isolated cases.They are industrial-scale operations with thousands of victims across various countries all across the globe. The only true defence is awareness and immediate action. Avoid shortcuts in investing, verify before trusting, and report frauds early. Let us stay informed, stay alert, and ensure we don’t become the next victims of these digital con artists.

Watch this conversation with our Cyber Security Expert at NRI Legal World.

Frequently Asked Questions

Q: How to prevent investment related cyber crime?

Ans: To protect yourself from sophisticated cybercrime syndicates—which often operate out of countries like Cambodia, Myanmar, and the UAE—you must employ a combination of technical vigilance and proactive legal steps. Here are some red flags you should know:

1) Always confirm before investing. It is recommended to confirm if the company is SEBI-registered before committing any funds. The legitimate schemes will never promise a fixed or unrealistically high returns on the investment(such as 30% monthly), through informal channels like WhatsApp or social media.

2) Never download .apk files or click on third-party links sent via messaging apps like Telegram or WhatsApp, as these often mimic genuine trading platforms to steal your data.

3) You can utilize open-source tools such as urlscan.io to analyze suspicious websites and ipinfo.io to check server origins. If a site uses international servers and lacks clear contact information, it should be treated as a major red flag.

4) Always be skeptical of psychological tactics used by the Investment Crime Syndicates. Initially, they often allow victims to withdraw small profits to build trust. It is a “psychological trick” designed to encourage much larger investments. Avoid being swayed by hours-long Zoom meetings with fake mentors or do not be impressed with doctored dashboards and screenshots showing high profit returns.

5) Seek professional financial or legal advice before investing any money to ensure it is not a digital trap.

Q: What Legal Action to take after Online investment fraud?

Ans: The most important action is the combination of Preventive Awareness before the crime and Immediate Reporting after the crime.

Tips on Legal Actions and Reporting:

If you suspect you have been targeted or have already lost funds in an online investment fraud, immediate action is the only way to potentially recover assets before they are laundered through multiple mule accounts or crypto transactions.

• Call the Cybercrime Helpline at 1930 or report the fraud at www.cybercrime.gov.in. As these syndicates use multi-layer money laundering, acting quickly increases the chances that law enforcement can freeze mule accounts.

• Collect and Submit Digital Evidence: When filing a First Information Report (FIR), you must include all digital evidence, such as screenshots of the ads, transaction histories, WhatsApp group chats and details, and any other communication with the scammers.

•Such organized crimes are now specifically recognized under the Bharatiya Nyaya Sanhita (BNS), which became effective on July 1, 2024. Take Professional Legal Advice.

• Most countries work in close coordination with each other when it comes to cracking down on these International organised syndicates. Report the crime to nearest authorities.

Q: How to recover the money lost in an online investment scam?

Ans: Recovering funds from new-age investment scams is exceptionally difficult due to several sophisticated structural mechanisms employed by transnational cybercrime syndicates. The scammers use a very complex network of multiple mule bank accounts to route the money. The use of such multilayer network makes it difficult to trace and recover the money. Hence, the time to report the crime plays a critical role.

Comments are closed