Understanding the Legal Consequences, ED Scrutiny, Penalties & Practical Guidance for NRIs

The Indian law prohibits NRIs from purchasing agriculture land, plantation land and farmhouse land in India. This restriction flows primarily from the Foreign Exchange Management Act, 1999 (FEMA) and the regulations framed thereunder.

Despite the clear ban, many NRIs knowingly or unknowingly purchase agricultural land through benami arrangements, or by using incorrect documentation. Most of the time it is observed that NRIs are wrongly advised by unprofessional local real estate brokers to buy agricultural land. In case any NRIs have purchased such restricted land this is a clear violation of FEMA, which may invokes the action by the regulatory authority i.e Enforcement Directorate. Prior knowledge about the FEMA regulations can help NRIs to take necessary steps to avoid the violations and penalties.

Legal Position in case an NRI has already purchased Restricted land in India:

If an NRI has purchased agricultural land, plantation property, or a farmhouse land in violation with FEMA regulations, the transaction is considered illegal. The Enforcement Directorate can initiate an investigation against the NRI.

The legal ramifications may include:

- The transaction is treated as a contravention of FEMA regulations.

- The Enforcement Directorate can launch investigations. Thus the land ownership comes under scrutiny.

- Authorities can directly confiscate the property and/or impose heavy penalties on the NRI.

- The prohibited land transaction can attract civil penalties as well as criminal cases against the NRI, even if there was no criminal intention at the part of the NRI.

It is important to understand that ignorance of law is not a defence. Even if the NRI relied on local agents, relatives, or incorrect legal advice, liability can still arise.

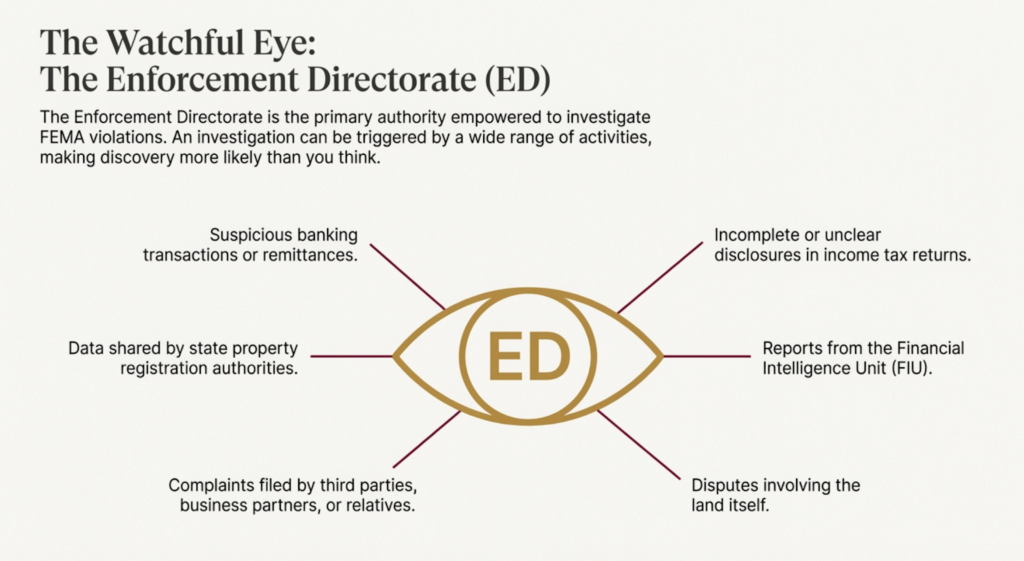

Role of Enforcement Directorate

The Enforcement Directorate is the empowered authority to investigate FEMA violations.

Possible grounds for ED to start investigation:

- Any Banking transaction hinting toward suspicious remittances

- Unclear/ incomplete disclosures in the income tax

- Any doubt emerges after Property registration data shared by state authorities

- Financial Intelligence Unit’s reports

- Complaints from third parties or relatives

- Voluntary disclosure by the NRI themselves

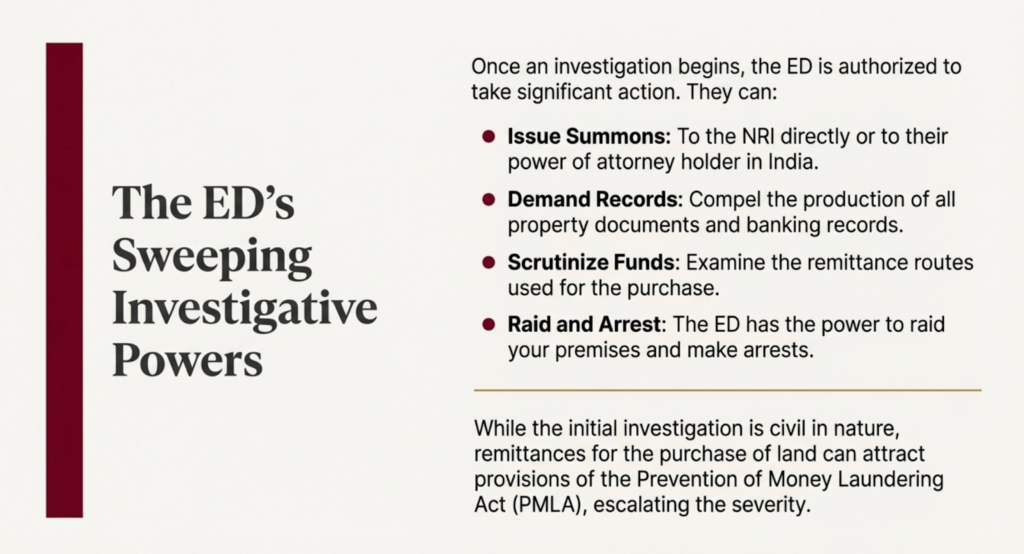

Scope of ED Powers:

The ED is authorised to:

- Issue summons to the NRI or their power of attorney holder.

- Demand property documents and banking records.

- Examine remittance routes used for purchase.

- Question compliance with FEMA and RBI regulations.

- Such enquiries are of civil in nature, remittance for purchase of land attract provision of Prevention of Money Laundering Act. But can become prolonged and financially burdensome.

Who is an NRIs according to FEMA ?

Any person or entity who does not meet the criteria of Resident Indian provided in the Official act, can be described as an NRIs.

The official definition of Resident of India provided in the act: “ (v)“person resident in India” means— (i) a person residing in India for more than one hundred and eighty-two days (182 days) during the course of the preceding financial year but does not include— (A) a person who has gone out of India or who stays outside India, in either case— (a) for or on taking up employment outside India, or (b) for carrying on outside India a business or vocation outside India, or (c) for any other purpose, in such circumstances as would indicate his intention to stay outside India for an uncertain period; (B) a person who has come to or stays in India, in either case, otherwise than— (a) for or on taking up employment in India, or (b) for carrying on in India a business or vocation in India, or (c) for any other purpose, in such circumstances as would indicate his intention to stay in India for an uncertain period; (ii) any person or body corporate registered or incorporated in India, (iii) an office, branch or agency in India owned or controlled by a person resident outside India, (iv) an office, branch or agency outside India owned or controlled by a person resident in India; (w) “person resident outside India” means a person who is not resident in India;.”

Know Your Residence Status:

The residential status under FEMA follows the main criteria that if an individual is in India for more than 182 days during the preceding financial year, he/ she shall be considered a Person Resident in India. However, there are two exceptions to this criterion. We recommend you to take advice from experts. You can contact our team of experts at info@nrilegalworld.com

Legal Case studies:

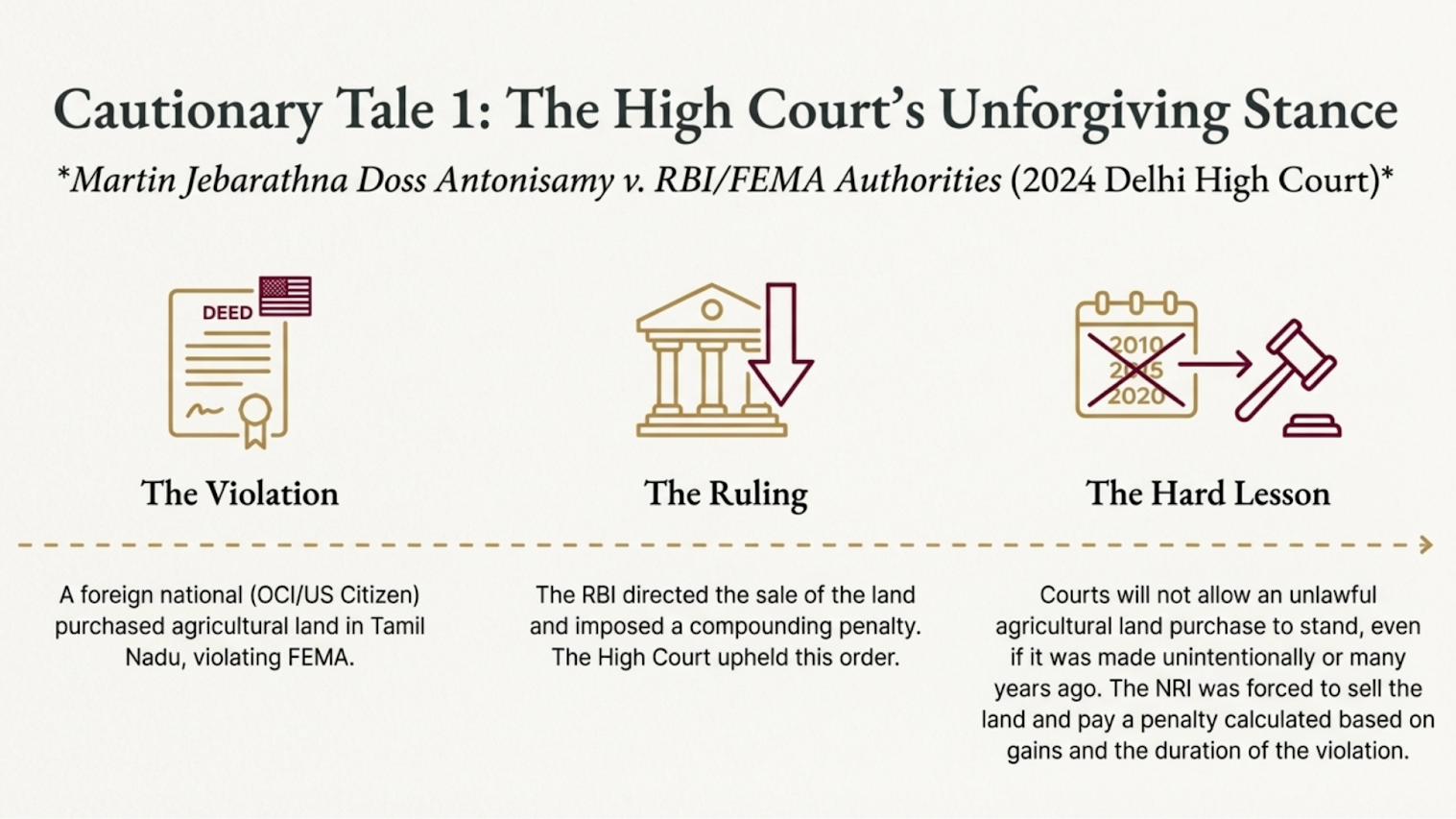

- Martin Jebarathna Doss Antonisamy v. RBI/FEMA Authorities (2024 Delhi High Court Matter)

Issue: A foreign national (OCI/US Citizen) purchased agriculture land in Tamil Nadu, violating FEMA restrictions.

RBI action: RBI Directed sale of land to an eligible resident and imposed compounding penalty.

High Court’s stance: The honourable High Court upheld the compounding order-confirming FEMA contraventions attract penalties even if the violation is long past.

Outcome: In this case the NRI had to sell the land and pay a penalty calculated considering gains and duration of contravention.

Significance for NRIs: It shows that the courts will not allow unlawful agriculture land purchase to stand even if made unintentionally.

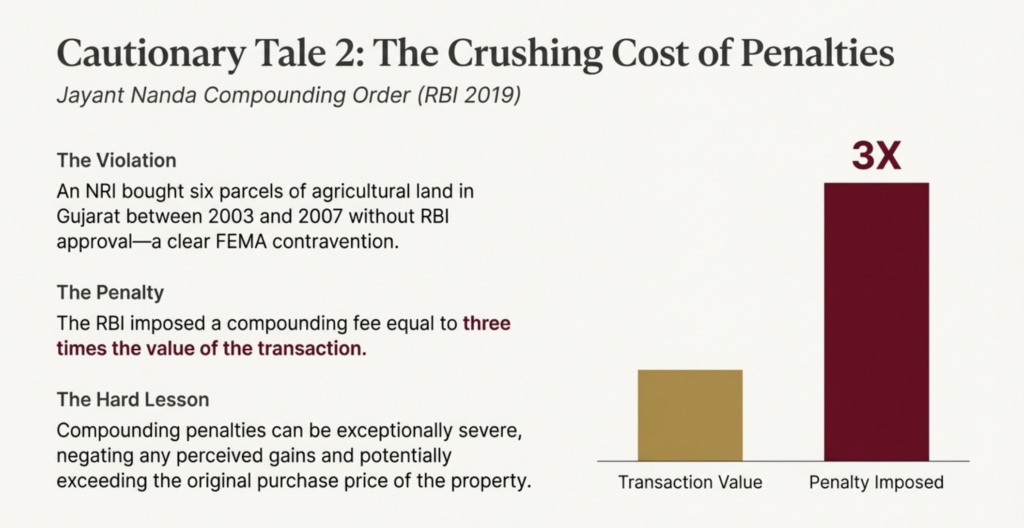

- Jayant Nanda Compounding Order (RBI 2019)

Issue: An NRI bought six parcels of agriculture land in Gujarat between 2003 and 2007 without RBI approval – a clear FEMA violation.

RBI action: RBI imposed a compounding fee equal to three times (3x) the value of the transaction.

Outcome: A Large penalty was imposed on NRI to penalize contravention and negate undue gain.

Significance NRIs: This illustrates how compounding penalties can be severe and even exceed the purchase price.

Legal options for NRIs who have purchased the Agriculture Land in India in the violation with FEMA Regulations

In case the NRI has already purchased restricted land, silence and inaction are risky. Proactive compliance is the safest approach for NRIs.

Key Recommendations:

- Consult a FEMA experienced legal expert immediately.

- Conduct a legal – Financial audit of the property transaction.

- Check the status of the land: Examine whether the land qualifies as agricultural or non-agricultural under state laws.

- Check if your residence status comes under the Definition of NRI as according to FEMA.

- Voluntary disclosure of the property and move for compounding of illegality.

- Maintain complete documents regarding the source of funds used for the purchase of the land deal, Inward /outward Remittance records and property registration details.

Pro tip: Early legal advice can significantly reduce penalties and future litigation risk.

NRI legal World

Declaring Land Assets in India

NRIs must ensure that all Indian assets are:

- Properly disclosed in foreign tax filings, where applicable.

- Reflected accurately in India compliance records.

- Supported by lawful acquisition documents.

- consult with professional experts

Non-declaration of assets may invite scrutiny by the Income Tax department and Enforcement authorities. Moreover ED collaborate with FIU ( Financial Intelligence Units) which monitors cross-boarder financial transactions for crimes like money laundering, tax evasion etc.

NRI Legal World

If you are an NRI who has already purchased land that may fall under restricted categories, do not delay corrective action. A timely discussion with legal professionals can help regularize issues, minimize penalties, and ensure peace of mind.

Want to know more about this topic:

Contact NRI Legal World : +919709692096

Email: info@nrilegalworld.com

advice on making a will Agriculture Land for NRis apply for oci card Best Legal Help For NRIs in India buying agricultural land NRI Can NRI buy Agriculture Land in India Defamation Case for NRIs FIR Agaisnt NRI how to write your own will Land mutation for NRIs legal advice on property Legal help for NRIs in India mutual consent divorce NRI nri agriculture land nri buying agriculture land in India NRI Buy Property India nri cyber crime NRI Defamation Case in India NRI Invest in India NRI Lal Lakir Property in villages NRI land disputes Punjab Nri lawyers NRI Legal Advice in India NRI Legal Help in India NRI legal services NRI Legal Updates NRI marriage disputes NRI marriage frauds NRI marriages nri property attorneys nri property lawyers NRI property management nri property rights NRI wills OCI card oci card for nris overseas citizenship of india power of attorney Power of attorney for NRI power of attorney for NRIS property management lawyers Property Registration for NRIs sell agriculture land NRI Selling Property in India

FAQS:

Q1. What is the legal status of land already purchased by an NRI in violation of FEMA?

Ans. Such a transaction is treated as a contravention of FEMA. The purchase is considered illegal under Indian law, even if it was done unintentionally or based on incorrect advice.

Q2. If NRIs purchase Property in violation with FEMA, will the property automatically become void or cancelled?

Ans. Not automatically. However, ownership rights can be questioned, and authorities may direct the NRI to sell or dispose of the property to an eligible resident Indian. Retention of the land is generally not permitted.

Q3. Can the Enforcement Directorate (ED) investigate NRI Land Transactions?

Ans. Yes. The Enforcement Directorate (ED) has full authority to investigate violations of FEMA, including illegal land purchases by NRIs.

Q4. On what grounds ED investigate NRIs under FEMA?

Ans. ED investigations may be triggered by:

- Bank reporting of foreign remittances

- Income tax proceedings

- Property registration data from state authorities

- Complaints from relatives or third parties

- Property disputes

- Voluntary disclosure by the NRI

Q5. How does ED investigate the FEMA violations by NRIs?

Ans. The ED can:

- Issue summons to the NRI or their Power of Attorney holder

- Call for property and banking documents

- Examine remittance routes

- Verify FEMA and RBI compliance

Although civil in nature, these proceedings can be lengthy and costly.

Q6. Can an NRI face imprisonment for FEMA violations?

Ans. FEMA does not prescribe imprisonment for simple contraventions. However, failure to comply and cooperate with ED or RBI orders can lead to arrest or other legal consequences.

Q7. Are past violations still punishable even if the purchase was made many years ago?

Ans. Yes. Courts have upheld penalties for old FEMA violations, as seen in recent High Court and RBI compounding matters. Time lapse does not automatically legalize an illegal purchase.

Q8. What are the specific ramifications and potential penalties FEMA Violations by NRIs?

Ans. The purchase of restricted property—specifically agricultural land, plantation land, or farmhouse land—by an NRI is a clear violation of the Foreign Exchange Management Act (FEMA) regulations, making the transaction illegal.

The legal ramifications and potential penalties for such FEMA contraventions are severe and primarily involve action by the Enforcement Directorate (ED), the regulatory authority empowered to investigate these violations.

If an NRI has already purchased restricted land, proactive compliance is the safest approach. Legal options include exploring:

• Voluntary disclosure of the property.

• Compounding of the offense.

• Sale or transfer of the property as per legal directions.

Seeking early legal advice can significantly reduce penalties and future litigation risk.

Q9: Which authority investigates FEMA violations done by NRIs?

Ans: The authority responsible for investigating violations of the Foreign Exchange Management Act (FEMA) concerning NRIs is the Enforcement Directorate (ED).

ED’s role include:

• The ED is the regulatory authority whose action is invoked when an NRI purchases restricted land (such as agricultural land, plantation land, or farmhouse land) in violation of FEMA regulations.

• The Enforcement Directorate is empowered to investigate FEMA violations.

• When an NRI purchases restricted land illegally, the ED can initiate an investigation on the NRI, causing the land ownership to come under scrutiny.

• The ED has various powers during an investigation, including issuing summons to the NRI, demanding banking records and property documents, and examining remittance routes.

• Grounds for the ED to start an investigation include suspicious banking transactions, unclear income tax disclosures, property registration data, FIU reports, and complaints from third parties.

While ED investigations are typically civil in nature, they can become prolonged and financially burdensome. Authorities, including the ED, are empowered to directly confiscate the property and/or impose heavy penalties for FEMA contraventions. Non-declaration of assets may also invite scrutiny by the Income Tax department and other Enforcement authorities.

Client Testimonial:

Read more blogs by NRI Legal World:

-

Annulment of Marriage for NRIs

For many Non Resident Indians (NRIs), marriage is not just a personal relationship, it is a legal bridge between countries, cultures, and immigration systems. A wedding may take place in India, while the couple lives abroad, relies on visas, sponsorships, and foreign residency laws. When such a marriage is later discovered to be fundamentally flawed…

Comments are closed