For Non-Resident Indians (NRIs) their ancestral land in India is not only an emotional legacy but also a secure high stake financial asset. When NRIs make the decision to liquidate these assets, many NRIs living abroad are blindsided by the complexities of Indian Law and Procedures. NRIs who want to sell their land in India require a granular understanding of Indian laws and procedural steps before making a land deal.

In cases where NRIs start the sale process of the land without professional and competent legal support or without a proper understanding of the whole process, the NRI risks significant financial erosion paired with decades long litigation. Hence, the NRIs have to be strategic about the sale of their land. This guide serves the purpose to equip NRIs with strategic insights and procedural guidance necessary to make a successful land deal.

5 Surprising Realities every NRI Must Know before selling their Agriculture land in India

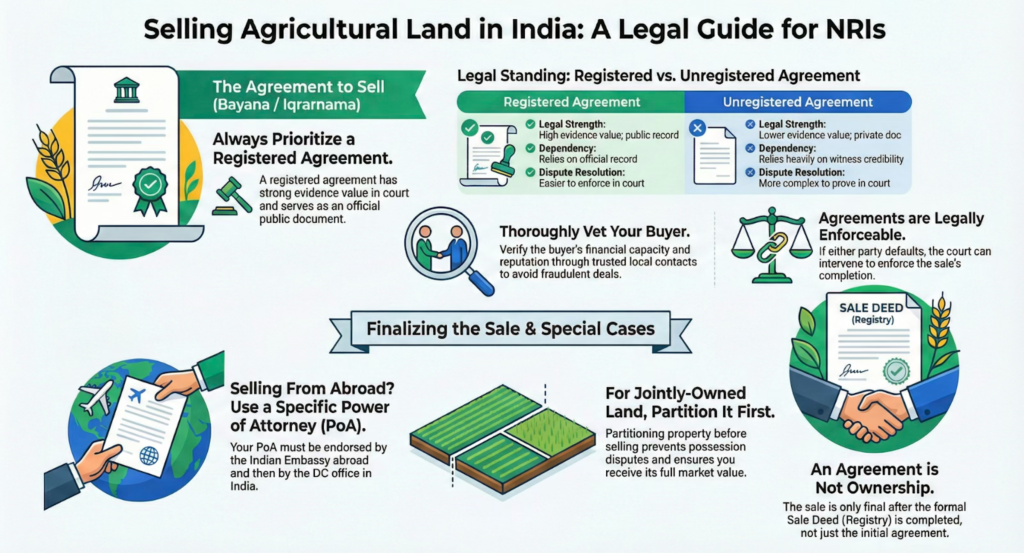

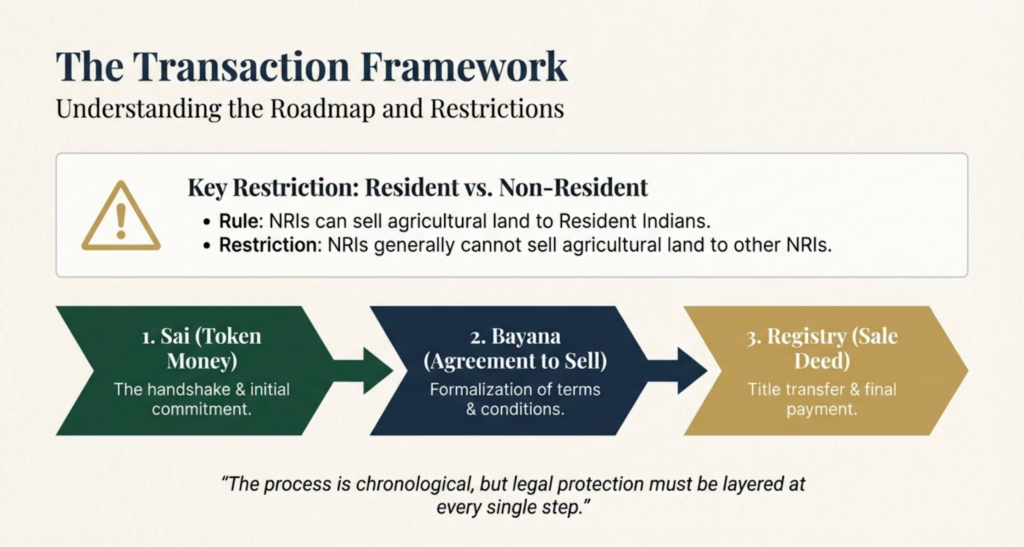

- NRI can sell their agriculture land to RESIDENT Indians only.

Under the current regulatory framework provided by FEMA and the guidelines by RBI and NRI is legally prohibited from selling agricultural land to another NRI or an Overseas Citizen of India (OCI). The land transaction is considered valid only if the buyer is a Resident Indian. Hence, knowing and verifying the residency status of a buyer is the absolute first step the NRI landowner must take.

2. Three stages of selling the land

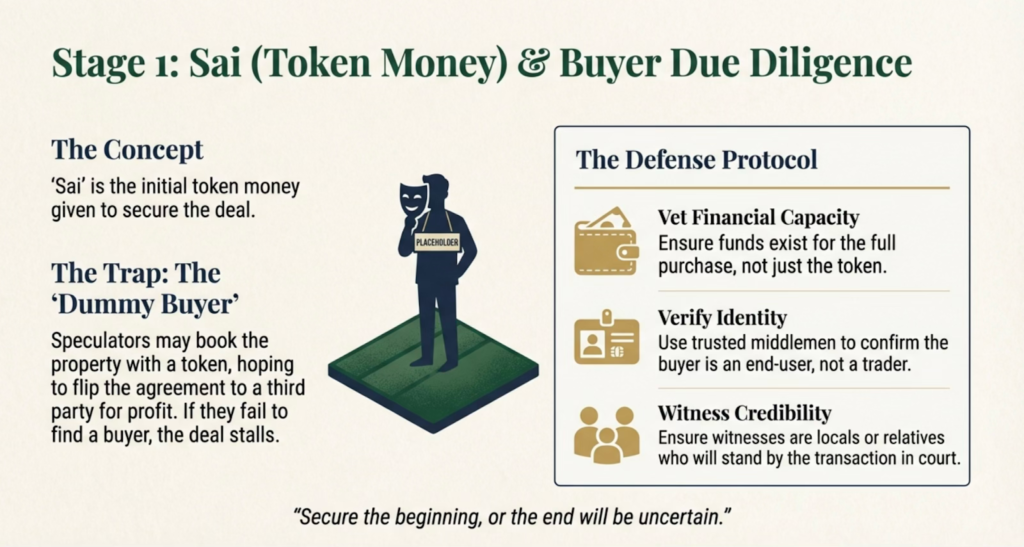

Any land sale in India follows a traditional three-stages path: a) Sai / Token Money, b) Bayana/ Sale Agreement and c) Registry / Sale Deed.

Token money acts as a written or verbal commitment from the seller that the land owner will not sell to other potential buyers available in the market until Bayana is registered. Token money is usually 1% to 5% of the total property value agreed upon. Token money is generally non-refundable if the buyer backs out. If the landowner backs out from selling the land the token amount paid is usually refunded.

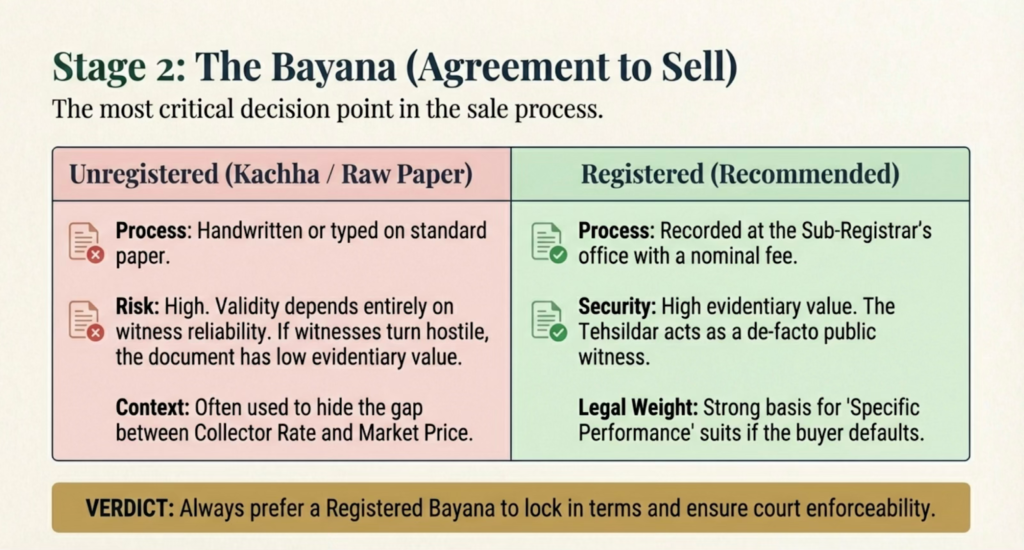

Bayana Agreement is often documented, after the token money, to formalise the land deal and its terms including final sale price, payment schedule, registration date and time and possession date clearly mentioned in it. Bayana is documented under the Indian Contract Act, 1872. The validity of the Bayana is decided in the agreement itself. A Bayana agreement is not a final transfer of ownership but it is a critical step in the Land sale Process.

If the buyer defaults the Bayana is usually forfeited.

If any party defaults from the Bayana, legal action can be taken against the defaulter party. Penalties for defaulters are also usually mentioned in the banana itself.

Tips for Buyers: Buyers must verify if the title of ownership of the land is clear and there are no dues pending against the land i.e to ensure if the property is free of encumbrances.Sometimes the buyer asked about Non-Encumbrance certificate which can be obtained from local Tehsildar Office.

Tips for NRI Landowners: To ensure robust legal protection, an NRI should insist on a Registering the Bayana or Sale Agreement at the Sub-Registrar’s office. By doing this the sale agreement becomes a “Public Document” with more evidentiary weight. Unlike an unregistered Bayana/ Sale Agreement, a registered sale Agreement allows the court to summon the Registry Clerk from the Tehsildar’s office as a witness. The clerk can produce the official record reflecting the registered sale agreement to verify the Land sale and thus the defaulting party can be held accountable.

Note: Registering the Bayana comes with additional costs to be paid at the Sub-Registrar office according to the value of the land.

3. Failure to Honour the sale agreement and Suit of Specific Performance

Once the Bayana/Sale Agreement is signed between buyer and the seller, it is mandatory for both of them to adhere to the settled terms and conditions. In cases where the seller attempts to back out of a deal after the Bayana/Sale Agreement is signed, the buyer can file a “Suit for Specific Performance” in the local civil court. The court has the authority to “step in” and complete the land transaction. The court can pass a decree to complete the sale agreement by execution of sale deed/registry of land through a court-appointed reader.This ensures that the sale is finalised even without the buyer’s cooperation.

In this case where the buyer backs out from honouring the terms of the Bayana/Sale agreement, the burden of proof lies with the NRI Landowner. NRI must ensure that they are “ready and willing” to perform their part of the contract which is selling the land to the other party. In case the Buyer is backing out from the Bayana/ sale agreement, the NRI land Owner (or their authorised representative) must visit the Tehsil office and record their presence via a formal affidavit attested by the Tehsildar, on the exact date specified in the Bayana for the final registry agreed upon in Bayana/sale agreement. This creates a definitive legal record that the seller was present and prepared to execute the Bayana/ sale agreement. This helps sellers by preventing the buyer from shifting the blame to the seller by claiming that the seller defaulted or attempted to sell the land to a third party.This helps keep the property free from any dispute.

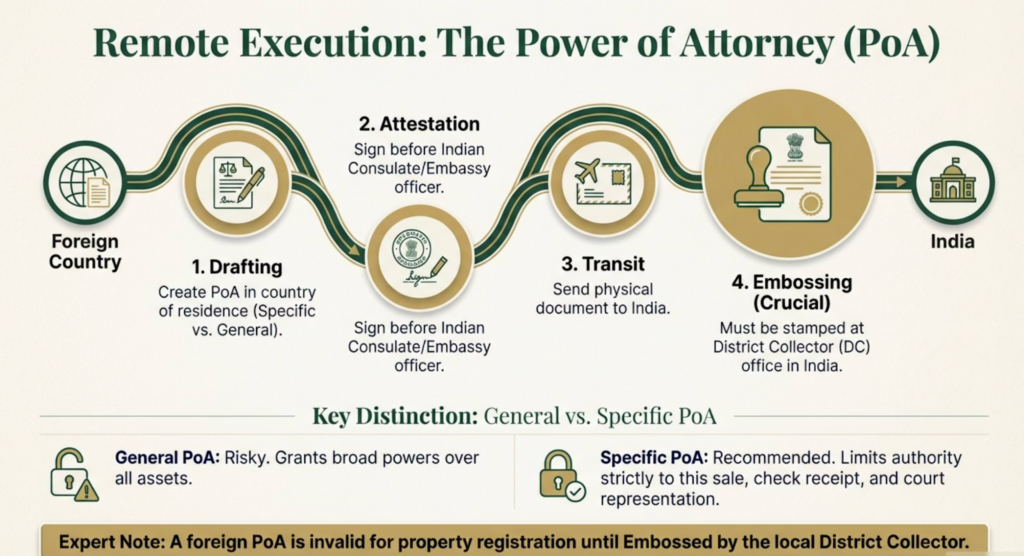

4. NRI selling land through Power of Attorney

NRI can authorise a trusted person, from family or friends, to initiate and conclude the land sale in India. Physical appearance is not a prerequisite to conclude the land sale in India, if NRI’s authorised representative ensures their presence to pursue the land deal on NRI’s behalf.

TIP for NRIs: Provide SPECIFIC Power of Attorney, not the General Power of Attorney.

NRI legal World

The essential steps for Power of Attorney:

- Notarisation: The Special Power of Attorney must be notarised in the NRI’s current country of residence.

- Embassy Attestation: The document must be formally attested by the Indian Embassy or Consulate.

- Registration of POA in India: Once the POA document arrives in India, it must be registered with the Deputy Commissioner (DC) office.

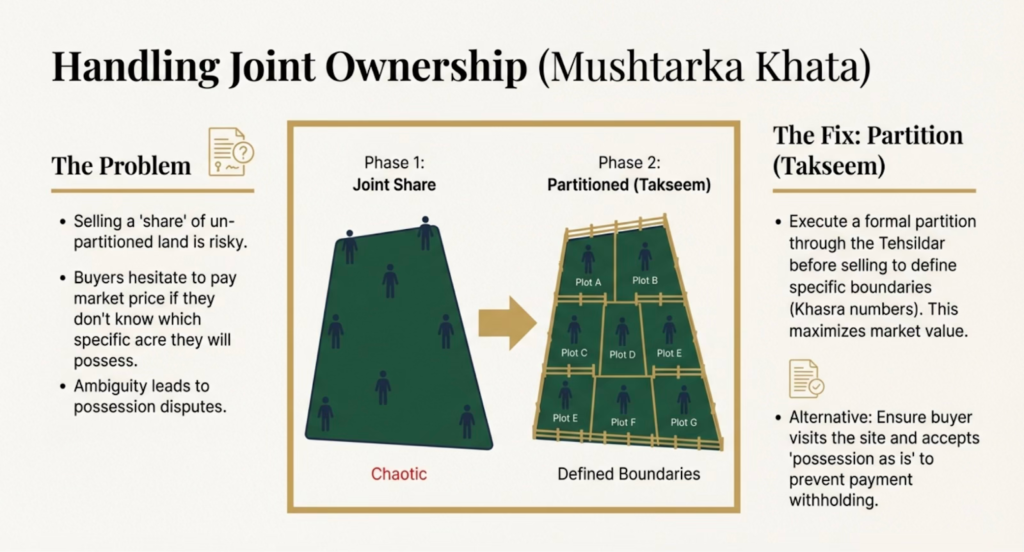

5. Sale of Land in joint ownership vs partitioned Land: Clarity of Title of ownership

The buyers are usually hesitant to buy land held in a Mushtarka Khata / Joint Ownership account because of the unclear title that is Possession / Kabza of the land. In such cases the buyers typically offer low value for the land, arguing that unpartitioned land which is not under the possession of the owner, such landowner need to first evict the illegal occupants from the land. This will empower the NRI landowner to ask the right price for their land. In order to remove the illegal occupants from the land the NRIs landowner can move to local civil court. Sometimes the possession of the landowner is established with the partition itself.

Hence, in order to get a maximal value for the land, it is recommended to NRI landowners to clear the land ownership title. That is to make sure that the land is partitioned with a clear ownership established and is clear from any loan/mortgage/encumbrance.

Partition of the land is a process of division of property among co-owners to provide each owner its exclusive right over their share in the property, thus providing clarity on boundaries and physical possession. NRI land owners should move toward partitioning/ Takseem of their land in case property is inherited or self acquired. It removes the ambiguity of possession that most of the time gives the buyers an excuse to demand sharp discounts.

NRI landowner looking forward to sell the property in India requires a rigorous due diligence into the title of ownership of the property and the verification of the buyer. In India’s real estate market where the market value of the property is historically high, the NRI landowner must not solely rely on the verbal promises offered to him. Would your current title of ownership survive a rigorous legal challenge today? If there you have even a shadow of doubt about the documentation of your land in India, it is a right time to seek expert guidance. Call NRI Legal World +919709692096 / info@nrilegalworld.com

Frequently Asked Questions

Q: How can NRI send a power of attorney for selling their land in India?

Ans: NRI land owners can send either a General Power of Attorney or a Specific Power of Attorney for the purpose of selling the land. It is recommended by our revenue experts at NRI Legal World to provide only a specific Power of attorney for a Specific purpose only. Our experts discourage NRIs to give the General power of attorney with authority to sell the land. NRI should only authorise the persons, relatives or friends who are trustworthy. The Special Power of Attorney can be given to complete any particular of the deal, means for the purpose of doing the Bayana/Sale Agreement or for the purpose of only registration of Property/ Sale deed.

Q: Is partition of the agriculture land necessary before selling the land?

Ans: It is always better to have a clear property ownership title. It means the property must be Legally partitioned and the possession (Kabza/Gardawri) of the land must be clear in favour of the NRI Land Owner. In most of the cases the NRIs hold land in joint ownership (Sanjha Khata), which can lead to disputes and lower sale prices in the market. On the other hand, there is no legal hurdle in selling the unpartitioned piece of joint ownership Land.

Q: How can an NRI Land owner verify the buyer?

Ans: NRIs should verify the financial capacity of the buyer through the local area network of acquaintances or relatives. NRI land owners must see if the buyer is genuinely interested in purchasing the property for his own use or if the buyer is merely a ‘dummy buyer’ looking to buy the property for some rotation of money to earn profit. Traditionally, Buyer and seller conduct a series of meetings in presence of witnesses to build trusts in both parties. It is always better to discuss your doubt with revenue and legal experts to avoid the chance of exploitation of NRIs landowners, as in some cases the buyers or property brokers try to take advantage of the naivety of NRIs about Indian law and procedures.

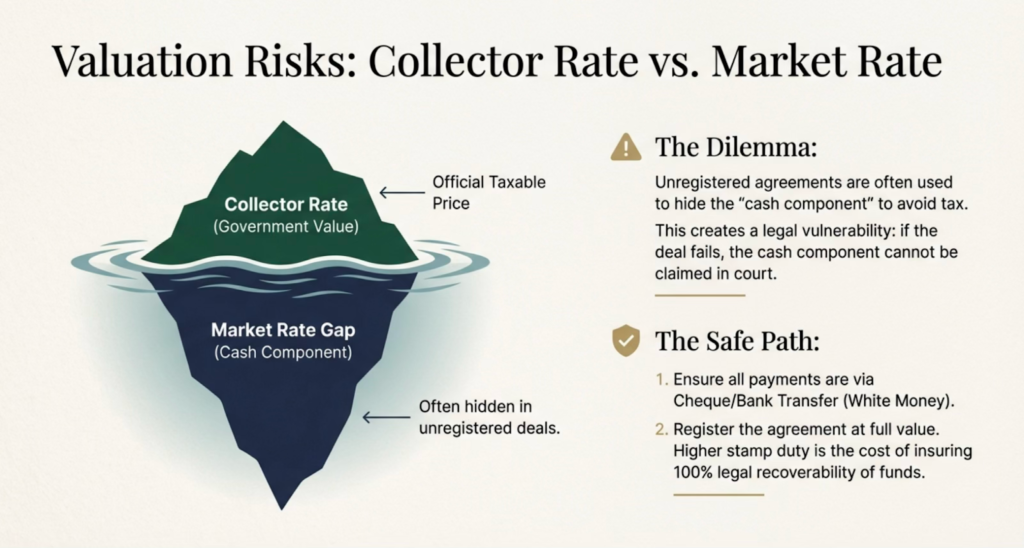

Q: What is the difference between collector rate and the market rate of the property in India?

Ans: The reality is that there is a huge gap between the collector rate and the market rate of the properties. This gap widens in localities where the real estate sector is in boom. It is generally seen that while transactions are often recorded at the collector rate to save taxes. In case of NRI landowners this gap in the official and unofficial values of the land is often exploited by the middlemen, property brokers or authorised power of attorney holders.These two values of the same property often cause difficulty for NRIs while they repatriate their funds from land transaction.

Q: How do NRI legalise a foreign Power of Attorney in India?

Ans: We recommend NRI to provide a special Power of Attorney, not the General Power of Attorney to complete the whole process of sale of land. Here are essential steps which should be followed:

- Notarisation of Special Power of Attorney in the NRI’s Current country of residence.

- Embassy Attention:The document must be formally attested by the Indian Embassy or Consulate.

- Registration of POA in India: Once the POA document arrives in India, it must be registered with the Deputy Commissioner (DC) office. Registration in India is mandatory to activate the POA.

Q: What happens if a property buyer backs out of a deal?

Ans: NRIs should always prefer registered agreements over informal or “Kacha” ones. Registered documents have significant evidentiary value in court, allowing an NRI to forfeit the amount paid by the buyer in the Bayana / Sale agreement. NRI should verify Buyer’s financial Capacity before entering in an agreement to sell their land. NRIs can use local relatives or trusted witnesses to verify the financial capacity of the buyer. This prevents buyers from “booking” the property for years just to flip it for profit, which often leads to litigation. NRI can record presence (Hajri) directly at the court, If a buyer fails to appear on the agreed registration date. NRI’s attorneys should record their presence at the Tehsildar’s office via an affidavit to prove the NRI was ready to perform their part of the contract. It provides a legal shield against the potential claims by the buyer on later stages.

Q: Why are Collector Rates and Market Rates different?

Ans: The Collector Rate is fixed by the government, and is often significantly lower than the actual Market Value due to several practical and financial factors. For NRIs it can cause major difficulties during the repatriation of funds, as an NRI may struggle to legally transfer the full market-value proceeds out of India if the official documents only reflect the lower Collector Rate.

Q: What happens if the NRI Landowner backs out from the terms set in the Sale Agreement, and does not want to proceed with registration of land to the buyer?

Ans: Sale Agreement signed by both the parties and witness is a legally binding contact. It is mandatory for both parties to adhere to the terms and conditions set in the sale agreement. If the NRI land owner backs out from executing the sale deed the buyer party can invoke the “suit for specific performance” as a legal remedy. In this the aggrieved party can approach the court to seek execution of the agreement.If the court finds that a valid agreement exists and one party is defaulting, it has the authority to pass an ex-parte decree. This allows the legal process to move forward even if the other party refuses to cooperate or show up in court.

Q: Should NRI land owners register the Bayana / sale agreement?

Ans: While a “Kacha” (unregistered) agreement can be used and is equally legally valid if it is signed in the presence of trustworthy witnesses. On the other hand a registered sale agreement is much stronger. It carries “presumption of truth” because the Tehsildar who registered it can be called to verify the document in court.

Q: For how long is the Bayana/ Sale agreement valid?

Ans: Until a specific time duration for legal validity is agreed upon and mentioned in the Bayana/sale agreement the Bayana agreement generally remains legally valid for three years.

Q: Can any party cancel the sale agreement by itself ?

Ans: No party can cancel the sale agreement unitarily. It can have legal complications.

Q: Can an attorney handle the partition of joint property in India?

Ans: Yes, an attorney can handle the partition of joint property (known as Musharka Khata) on behalf of an NRI who is abroad. While the NRI remains abroad, their representative can manage the entire partition procedure provided they hold a legally verified and embossed Specific Power of Attorney

Comments are closed